The tax rewards are what make SDIRAs attractive for many. An SDIRA could be the two common or Roth - the account type you choose will count largely on the investment and tax technique. Check out with your money advisor or tax advisor for those who’re Uncertain that is most effective for yourself.

IRAs held at banks and brokerage firms present restricted investment options to their shoppers simply because they do not need the knowledge or infrastructure to administer alternative assets.

Have the liberty to speculate in Just about any sort of asset using a hazard profile that matches your investment technique; like assets which have the probable for the next rate of return.

Shifting funds from a single form of account to another variety of account, like relocating resources from the 401(k) to a standard IRA.

Yes, housing is one of our clients’ hottest investments, at times called a housing IRA. Consumers have the option to take a position in almost everything from rental properties, business property, undeveloped land, property finance loan notes and even more.

Criminals at times prey on SDIRA holders; encouraging them to open accounts for the purpose of making fraudulent investments. They often idiot buyers by telling them that If your investment is approved by a self-directed IRA custodian, it need to be authentic, which isn’t legitimate. All over again, Make sure you do comprehensive due diligence on all investments you decide on.

The leading SDIRA policies from your IRS that investors will need to be aware of are investment limitations, disqualified folks, and prohibited transactions. Account holders have to abide by SDIRA principles and polices so as to preserve the tax-advantaged standing of their account.

Client Guidance: Search for a supplier that gives committed support, which includes use of proficient specialists who will answer questions about compliance and IRS guidelines.

This involves being familiar with IRS regulations, managing investments, and steering clear of prohibited transactions that can disqualify your IRA. An absence of information could cause high priced problems.

Therefore, they have an inclination not to market self-directed IRAs, which provide the flexibility to speculate in the broader variety of assets.

And because some SDIRAs which include self-directed classic IRAs are topic to necessary minimum amount distributions (RMDs), you’ll need to prepare forward to ensure that you've got plenty of liquidity to fulfill The foundations established via the IRS.

Entrust can assist you in purchasing alternative investments along with your retirement funds, and administer the getting and offering of assets that are usually unavailable by means of financial institutions and brokerage firms.

When you finally’ve observed an SDIRA company and opened your account, you could be wanting to know how to truly commence investing. Comprehension equally the rules that govern SDIRAs, in addition to how you can fund your account, can help to put the inspiration to get a way forward for prosperous investing.

As opposed to shares and bonds, alternative assets in many cases are harder to provide or can include strict contracts and schedules.

When you’re trying to find a ‘established and fail to remember’ investing technique, an SDIRA likely isn’t the best choice. Simply because you are in total Management more than just about every investment produced, It can be up to you to carry out your own private due diligence. Don't forget, SDIRA custodians are not fiduciaries and cannot make suggestions about investments.

Homework: It truly is known as "self-directed" click resources for your cause. Having an SDIRA, you might be solely liable for comprehensively studying and vetting investments.

Right before opening an SDIRA, it’s important to weigh the potential benefits and drawbacks depending on your certain economic targets and threat tolerance.

Minimal Liquidity: Many of the alternative assets which can be held within an SDIRA, which include housing, personal equity, or precious metals, is probably not easily liquidated. This may be a difficulty if you need to entry resources speedily.

Greater helpful site investment choices suggests it is possible to diversify your portfolio outside of shares, bonds, and mutual cash and hedge your portfolio in opposition to market place fluctuations and volatility.

Shaun Weiss Then & Now!

Shaun Weiss Then & Now! Amanda Bynes Then & Now!

Amanda Bynes Then & Now! Charlie Korsmo Then & Now!

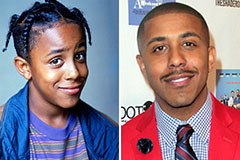

Charlie Korsmo Then & Now! Marques Houston Then & Now!

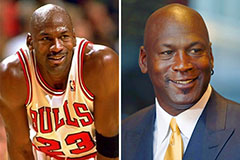

Marques Houston Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now!